- AI Investing Pulse

- Posts

- How Do Big Tech Hide Their AI Debt?

How Do Big Tech Hide Their AI Debt?

Summary

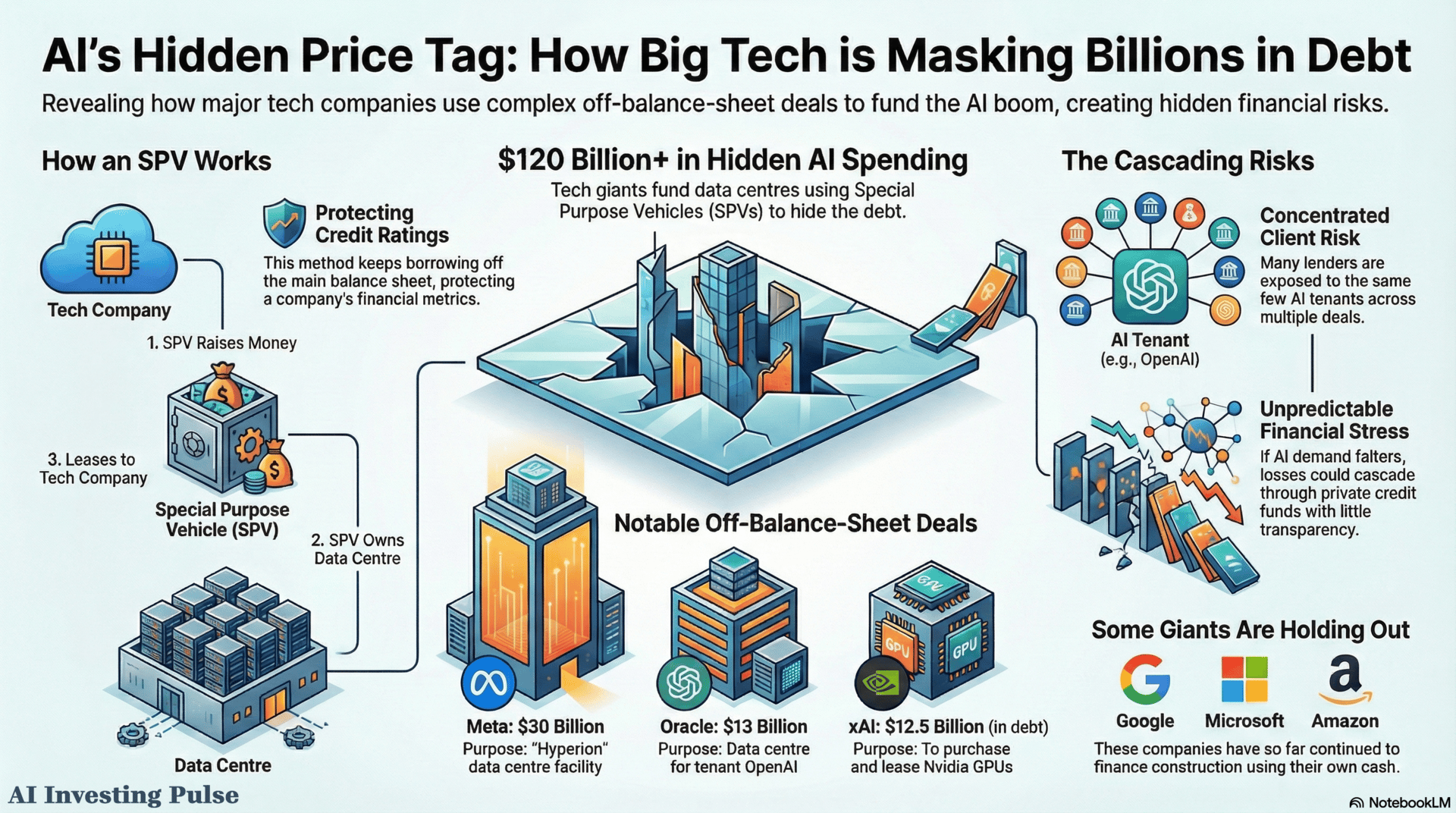

Here we examine the article “Big Tech hiding AI debt”, published by Fudzilla, which reports that major technology companies are using complex but legal financial structures to keep the enormous cost of building AI infrastructure out of their published accounts. To pay for data centres and high-end computer chips without harming their financial ratios, companies such as Meta $META ( ▲ 0.62% ) , Oracle $ORCL ( ▲ 1.43% ) and Elon Musk’s xAI have shifted an estimated $120 billion of spending off their balance sheets.

They achieve this by collaborating with Wall Street firms to create separate financial entities. This allows tech giants to access the trillions of dollars needed for the AI arms race while maintaining the appearance of having little debt, thereby protecting their credit ratings and stock prices,. While this keeps their official books clean, it creates a "hidden debt" that experts warn could cause systemic financial issues if the AI market becomes unstable.

The infographic was created by AI Investing Pulse, based on “Big Tech hiding AI debt”, published by Fudzilla

How They Do It?

The process relies on a financial mechanism known as a Special Purpose Vehicle (SPV). Here is the step-by-step process described in the source:

1. Partnership: A tech company (e.g., Meta or Oracle) partners with private equity firms and asset managers like BlackRock, Blue Owl Capital, or Pimco,.

2. Creation of an SPV: They form a specific holding company (the SPV) for a particular project. For example, Meta created an SPV called "Beignet Investor" for a facility in Louisiana.

3. Raising Debt: The SPV—not the tech company—borrows the money. In the Beignet Investor deal, the SPV raised 30billion(27 billion in debt and $3 billion in equity).

4. Leasing: The tech company agrees to lease the data centre or computing power from the SPV. Because the SPV holds the loan, the massive debt does not appear on the tech company's balance sheet,.

5. Guarantees: In some cases, the tech company provides a "residual value guarantee," promising to pay investors if the value of the assets drops below a certain point, meaning they are still financially on the hook despite the accounting tricks.

Who Benefits?

• Tech Companies (Meta, Oracle, xAI, CoreWeave): They can secure tens of billions in cash to build infrastructure immediately without lowering their credit ratings or showing massive liabilities to shareholders,. This allows them to raise additional funds in the corporate bond market more easily.

• Private Capital & Wall Street: Firms like BlackRock, Apollo, and Blue Owl Capital benefit by deploying huge amounts of capital into high-demand assets. The article notes that private capital investors are eager to enter the AI boom, with $125 billion flowing into such deals in 2025 alone.

• Legacy Hyperscalers (Indirectly): While companies like Microsoft $MSFT ( ▲ 0.69% ) , Google $GOOG ( ▲ 0.37% ) , and Amazon $AMZN ( ▲ 1.81% ) are currently financing construction with cash or traditional debt and have not disclosed significant SPV usage, they benefit from the overall liquidity in the market, though they are currently hiding their financing strategies better or exercising restraint.

The Risks

The article highlights several dangers associated with this trend:

• Systemic Contagion: Because many companies are using the same "template" for these deals, financial stress could spread rapidly across Wall Street. If the AI market falters, the pain would hit many private credit funds simultaneously,.

• Hidden Leverage: Investors may believe tech companies are financially healthier than they actually are. While the debt is technically "off-balance sheet," the companies often have guarantees that make them liable if things go wrong, meaning their credit quality is worse than modelled.

• Concentration Risk: The AI boom relies on a small group of clients. For instance, OpenAI has over $1.4 trillion in computing commitments. If a major tenant like OpenAI falters, lenders across multiple different SPVs could face losses simultaneously,.

• Asset Devaluation: These deals assume data centres and chips will retain value. If AI demand disappoints or technology makes current hardware obsolete, the collateral backing these huge loans effectively becomes worthless,.

Car Analogy

Imagine you want to buy a luxury sports car, but you cannot afford to have a massive car loan show up on your credit report because you are applying for a mortgage. Instead of buying the car yourself, you ask a wealthy friend (the SPV) to take out the loan and buy the car. You then sign a contract to rent the car from your friend for a monthly fee.

• The Benefit: The bank looking at your mortgage application thinks you have zero debt.

• The Reality: You are effectively paying off the car loan through rent.

• The Risk: If you lose your job (AI demand drops) and stop paying rent, your friend defaults on the loan. Furthermore, if you signed a secret agreement promising to pay your friend the difference if the car's value crashes (Residual Value Guarantee), you are still completely financially responsible, even though the bank never saw the loan on your file.

Disclaimer

This content is provided for informational and educational purposes only and does not constitute investment advice, personal recommendations, or an invitation or inducement to engage in any investment activity.

AI Investing Pulse (AIIP) is a publisher of financial research and commentary and is not authorised or registered as an investment adviser, portfolio manager, or securities dealer with any regulatory authority in the United Kingdom (FCA), United States (SEC or any state regulator), or Canada (any provincial securities commission or CIRO).

The information presented is derived from publicly available sources believed to be reliable but should not be solely relied upon for making investment decisions. Always consult a qualified, regulated financial professional before acting on any information. Past performance is not a guide to future results.

About AIIP Index: The AIIP Index tracks 173 AI-focused public companies across the full AI stack and serves as our benchmark for sector performance. All scores are proprietary and calculated using data from Finbox (powered by S&P Global Intelligence) and track the last 7 calendar days for weekly performance. The AIIP Total Score (0–100) combines metrics for sales and EPS growth, financial quality, and valuation to assess overall business strength. AIIP Relative Strength (RS) Score measures a stock’s price performance relative to the AIIP universe. Ranking status is based on score combinations:

Fundamental = Total Score ≥ 70 and RS < 80, Momentum = RS ≥ 80 and Total Score < 70, Watchlist = Total Score ≥ 70 and RS ≥ 80.